Idea #391 – Allow Hotels and B&Bs in Bylaws

Report Status: Fully Reviewed

Researched by: Brian Antonellis

Original Idea as Submitted

Write bylaws enabling hotels and bed & breakfasts in Belmont. In recent years, there have been two instances in which developers have proposed hotels, and were rejected in part because our bylaws did not address hotels.

Hotels would create local jobs, bring consumers and other businesses into the area, potentially host restaurants and events, and generally boost the local economy. Obviously, they would increase tax revenues as well.

Other ideas included in this report

- None

Idea intent

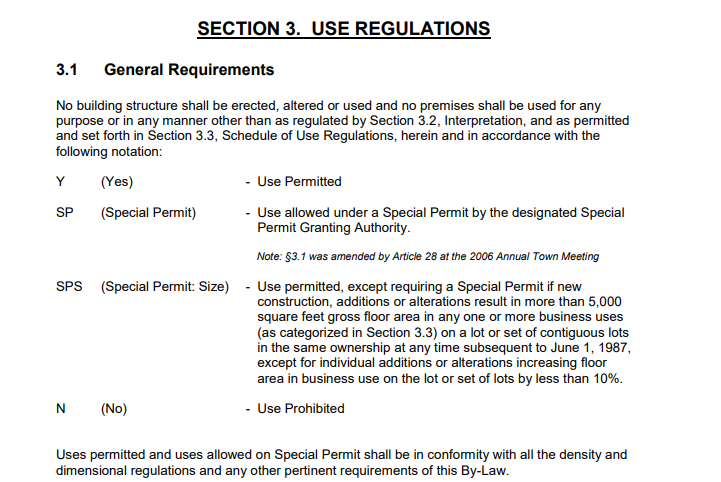

Clarity Zoning and by laws to allow areas for hotels and set up rooms tax

Weighted Final Score: 43 (Financial Impact: 3, Operational Impact: 2, Time Scale: 2, Ease of Implementation: 3)

Background Information

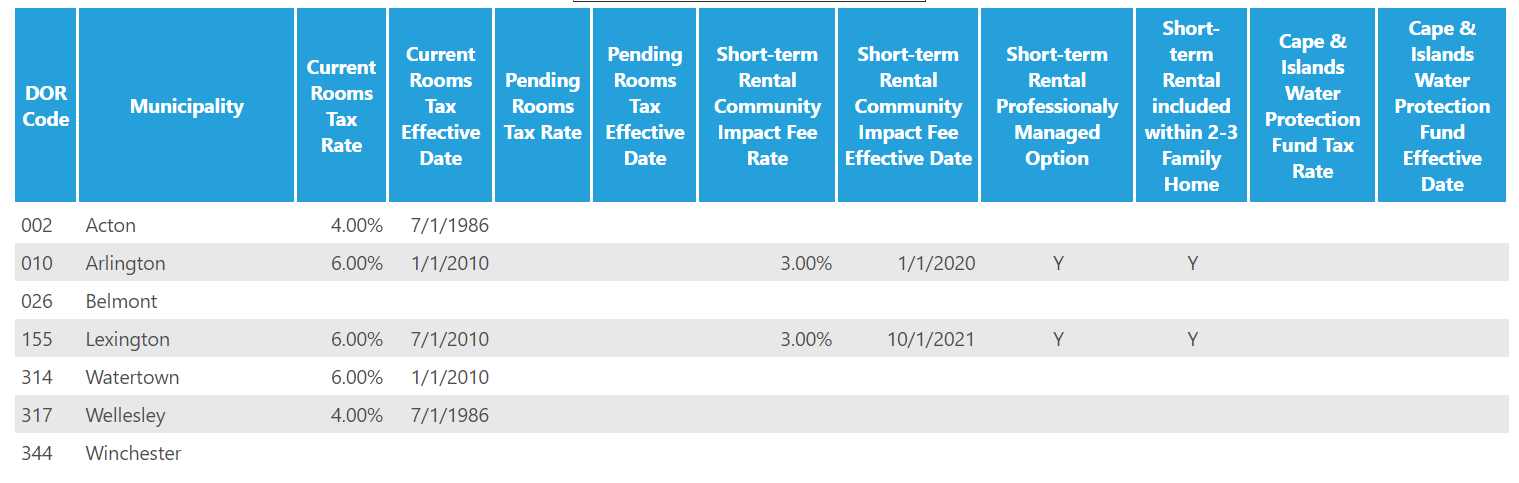

Massachusetts has a state room occupancy excise tax rate of 5.7%. Depending on the city or town, a local option room occupancy tax and other taxes and fees may also apply. The room occupancy excise tax applies to room rentals of 90 days or less in hotels, motels, bed and breakfast establishments, and lodging houses. Beginning July 1, 2019, the room occupancy excise also applies to short-term rentals of property for 31 days or less. For all types of rental accommodations, if the total amount of rent is less than $15 per day, no tax is due. Generally, the room occupancy excise is collected and paid to DOR by a person or business called an operator. As of July 1, 2019, new rules require an intermediary or other agent collecting rent to file returns and pay taxes to DOR.

Recommendations

-

Establish a Rooms Tax and short-term rental community fee similar to neighboring towns e.g., Arlington, Watertown, and Lexington. (see Idea #271)

-

Establish zoning for limits on the scale and type of hotels we want in town and locations where they will not be a detriment to the town. Hotel developers should know locations they will not have risk of not being able to develop as long as they are within code.

Next Steps

- Identify locations and work to write new town bylaws.

Further Reading

-

[Room Occupancy Excise Tax Mass.gov](https://www.mass.gov/info-details/room-occupancy-excise-tax) -

[Local Options Relating to Property Taxation, CPA, Meals and Room Occupancy Mass.gov](https://www.mass.gov/service-details/local-options-relating-to-property-taxation-cpa-meals-and-room-occupancy)