Idea #271 – Tax Revenue from Short-term Rentals

Report Status: Fully Reviewed

Researched by: Joe Bernard

Original Idea as Submitted

Issue licenses for AirBnB and other host services and collect tax revenue on that.

Other ideas included in this report

- 285: Belmont categorizes Airbnb-type rentals like a bed and breakfast. In residential neighborhoods, residents can rent up to three rooms in their house for seven days or longer. Short-term rentals, however, require special permit from Zoning Board of Appeals. Could this restriction be reviewed and possibly be loosened or lifted in order to generate more revenue?

Idea intent

Regulating short-term rentals would generate more tax revenue for the Town.

Weighted Final Score: 47 (Financial Impact: 3, Operational Impact: 2, Time Scale: 3, Ease of Implementation: 3)

Background Information

In December 2018, the Governor signed Chapter 37 of the Acts of 2018, An Act regulating and insuring short-term rentals, amending Chapter 23A of Massachusetts General Laws. The Act expanded the state room occupancy excise tax to include “short-term rentals”, meaning an occupied property that is not a hotel, motel, lodging house, or bed and breakfast, where at least one room or unit is rented out through the use of advance reservations for a period of not more than thirty-one consecutive calendar days.

In addition to the state excise, each Massachusetts city and town may impose a local option room occupancy excise tax of up to 6% of the amount of rent, and the Act likewise expanded the local option excise to apply to short-term rentals. The local excise would apply to the same occupancies as the state excise. Further, the Act allows cities and towns that have imposed the local option excise to impose community impact fees of up to 3% of the amount of rent on two separate types of short-term rentals: 1) a “professionally managed unit”, defined as one of two or more short-term rental units in the same city/town not located within a dwelling that includes the operator’s primary residence, and 2) a unit that is located within a two-family or three-family dwelling that includes the operator’s primary residence. To be clear, if a community has not adopted a local option room occupancy excise, it cannot adopt a community impact fee; likewise, if a community has not adopted the first type of community impact fee, it cannot adopt the second.

As of now, Belmont has not adopted a local room occupancy excise tax. It can do so by a majority vote of Town Meeting accepting G.L. c. 64G, § 3A and establishing the rate, up to 6% of rent. If Belmont adopts a local option excise, it can then also adopt one or two community impact fees by a majority vote of Town Meeting accepting G.L. c. 64G, § 3D and establishing the rate, up to 3% of rent.

If adopted, the Town will not be required to collect the excise or the community impact fee, since they are paid directly to MA Department of Revenue (DOR) and then distributed from DOR to the Town on a quarterly basis. Owners/operators of short-term rentals are required to be registered with DOR. As of January 14, 2022, there are thirty-seven properties in Belmont that are registered with DOR as short-term rental properties.

Revenue from the local option excise is general fund revenue and may be appropriated for any municipal purpose. Revenue from the community impact fees is partially restricted: at least 35% must be dedicated to affordable homes or local infrastructure projects. A “local infrastructure project” is a capital project for which a community could borrow, but not to fund the payment of debt service.

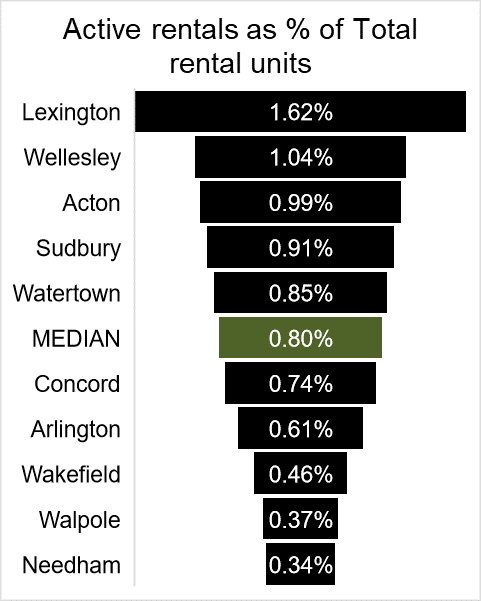

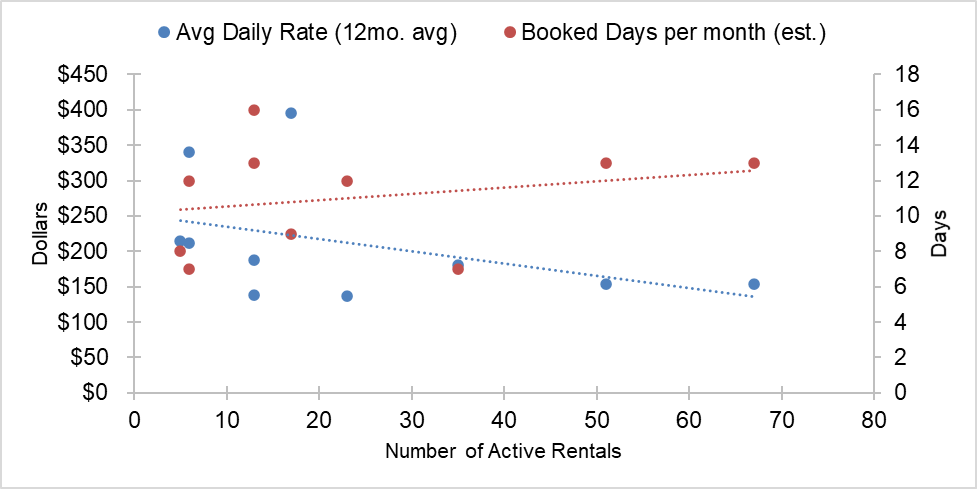

As part of the research process for this idea, housing data was obtained from the U.S. Census Bureau (2019 American Community Survey 5-Year Estimates) and short-term rental data was obtained from AirDNA (a firm that tracks the performance of properties on Airbnb and Vrbo). Figure 1 shows data points from the following ten nearby municipalities, all of which have adopted the local option room occupancy excise: Watertown, Arlington, Lexington, Acton, Wellesley, Concord, Wakefield, Needham, Walpole, and Sudbury.

Applying the median percentage of active rentals per total rental units (from Figure 2) to Belmont’s rental housing stock, Belmont could reasonably expect 29 active short-term rentals. Given that, using the trendlines of market data from Figure 1, Belmont could reasonably expect a $202 average daily rate, and 11 booked days per month per short-term rental property.

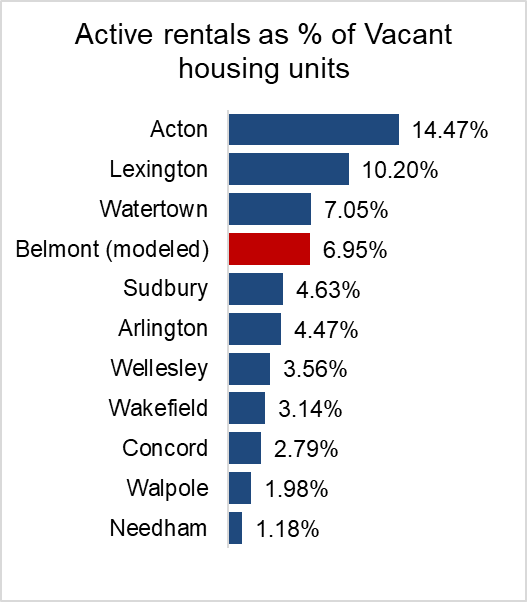

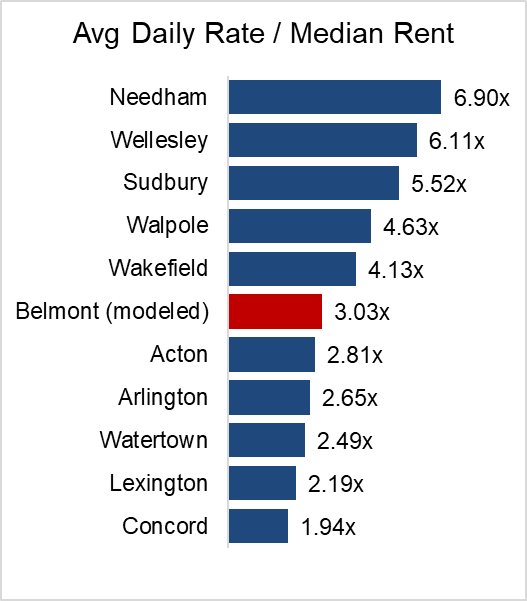

To further test reasonableness of these estimates, comparisons of the number of active short-term rentals to vacant housing units and the average daily rate to median rent are shown in Figure 3.

Based on these estimated variables, if all active rentals met the criteria for a community impact fee, Belmont’s adoption of a 6% local excise and 3% community impact fees would generate additional revenue of $70,796 per year.

One argument against allowing short-term rentals is the potential for property owners to convert existing long-term rental units to short-term rental units, thereby creating pressure on the market for long-term rentals and creating conditions that might cause displacement of current residents. Belmont could mitigate this risk by pairing it with a bylaw designed to relieve pressure on the long-term rental market. For example, implementing an accessory dwelling unit bylaw would allow homeowners to rent out a self-contained apartment in their owner-occupied single-family home. This works well in communities where land for new construction is limited and demand for housing is high, such as Belmont.

Recommendations

-

Select Board and Planning Board jointly present articles for Town Meeting to adopt a local option room occupancy excise at 6% of rent, as well as two community impact fees at 3% of rent

-

Select Board and Planning Board jointly present article for Town Meeting to implement an accessory dwelling unit bylaw

Next Steps

- With reference to the Airbnb analysis provided to the Select Board by the Planning Board (as noted in the Planning Board’s meeting minutes from December 3, 2019), Select Board to initiate further discussions with the Planning Board, Housing Trust, and broader community about the opportunity for additional revenue from short-term rental excise taxes and fees, as well as an accompanying bylaw to mitigate risk of displacement of residents

Further Reading

-

An Act regulating and insuring short-term rentals

https://malegislature.gov/Laws/SessionLaws/Acts/2018/Chapter337 -

FAQs providing information of interest to municipal officials regarding An Act regulating and insuring short-term rentals

https://www.mass.gov/doc/room-occupancy-excise-faqs-short-term-rentals/download -

MA Division of Local Services’ Municipal Databank

https://dlsgateway.dor.state.ma.us/reports/rdPage.aspx?rdReport=LocalOptions.Room_Tax_Impact_Fee -

U.S. Census Bureau

https://data.census.gov/cedsci/profile?g=1600000US2505105 -

AirDNA

https://www.airdna.co/ -

Mass.gov information on Accessory Dwelling Units

https://www.mass.gov/service-details/smart-growth-smart-energy-toolkit-modules-accessory-dwelling-units-adu -

Planning Board meeting minutes from June 18, 2019

https://www.belmont-ma.gov/sites/g/files/vyhlif6831/f/minutes/2019-06-18_planning_board_minutes.pdf -

Planning Board meeting minutes from December 3, 2019

https://www.belmont-ma.gov/sites/g/files/vyhlif6831/f/minutes/2019-12-03_planning_board_minutes.pdf