Idea #101 – Payments In Lieu Of Taxes for Non-Profits and Private Schools

Report Status: Fully Reviewed

Researched by: Joe Bernard and Brian Antonellis

Original Idea as Submitted

Seek PILOT payments from non-profits and private schools. Define and document direct services provided by the Town for each nonprofit organization.

Other ideas included in this report

-

#102: Request from each nonprofit organization a list of services they provide the Town.

-

#103: Seek financial support/partnership for upgrades of facilities used by nonprofits.

-

#104: Tax Belmont Hill and Belmont Day or pursue a PILOT donation every year.

-

#105: Build PILOT program using Northampton analysis to assess municipal costs and assign value to non-cash services provided by non-profit.

-

#111: PILOT payments (Payment in Lieu of Taxes)

-

#256: Lobby to remove tax exemption state law for golf courses to augment tax revenue. Golf courses are allowed to count the course as open space and pay a lower percentage of taxes than the land would otherwise generate.

-

#294 [shortened]: Belmont Hill Club pays significantly reduced taxes for having open space. Since this is private land used for their own endeavors, could that lowered tax burden be re-addressed? Could the Town look at other tax breaks given to private entities and the reasons behind them.

-

#305 [shortened]: Go after McLean for PILOT cash and not let them move forward with their school development project until we get it.

-

#352: Lobby with legislature for the PILOT program to be mandatory. Impose mandatory tax on all non-profits.

Idea intent

Additional revenue could be raised from tax-exempt property owners in the form of Payments in Lieu of Taxes (PILOT)

Weighted Final Score: 47 (Financial Impact: 4, Operational Impact: 2, Time Scale: 2, Ease of Implementation: 2)

Background Information

The Town of Belmont provides important services to property owners: street maintenance, fire protection, snow removal, etc. Although property taxes are the primary source of funding for local services, the benefits of these services are enjoyed by both taxable and tax-exempt property owners. Certain institutions and organizations qualify for exemption from property taxes; these exemptions are found in various clauses of Massachusetts General Laws. To ease the tax burden on taxable property owners, PILOT payments can be made by tax-exempt property owners.

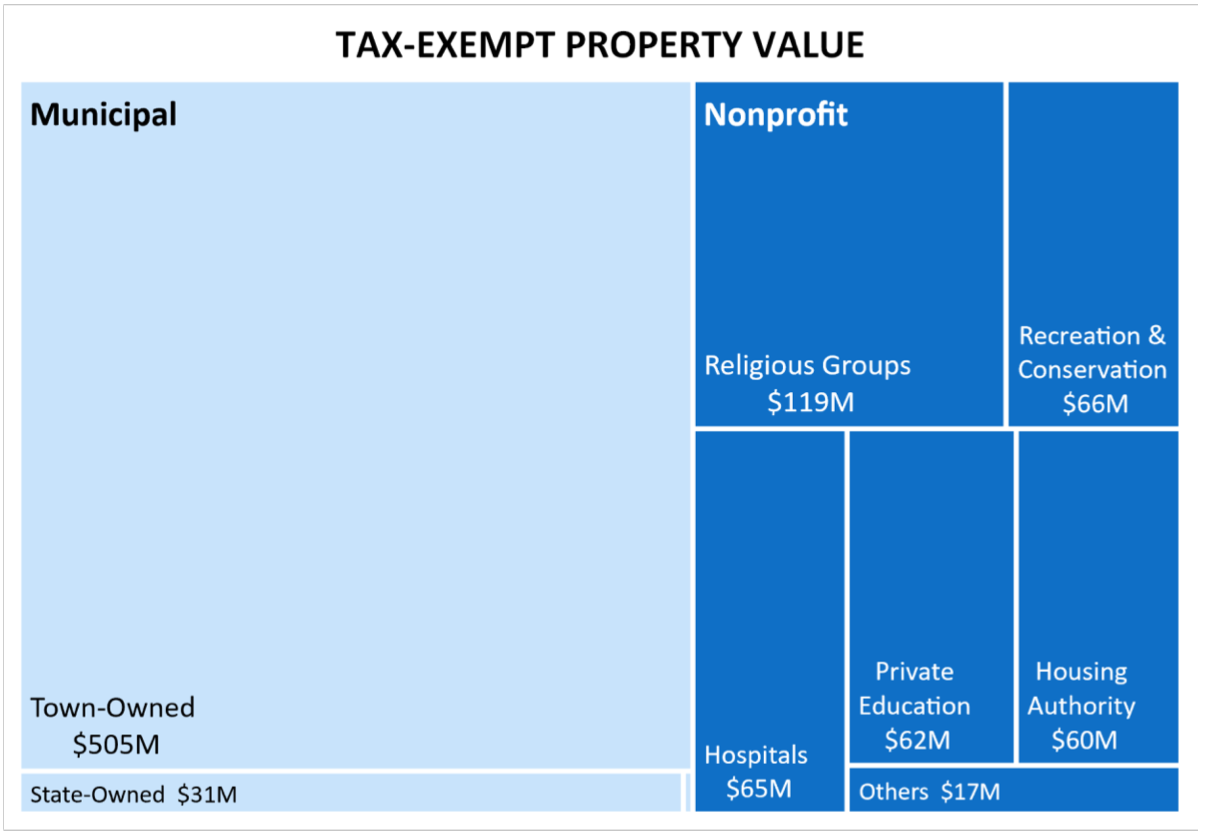

Tax-exempt properties in Belmont have many different owners and uses, including municipal buildings and parks, religious institutions, recreation, hospitals, private education, housing, and others. The following chart (Figure 1) categorizes the tax-exempt property in Belmont, reflecting FY21 assessment values.

Figure 1: Tax-Exempt Property Value, FY21 amounts from the Belmont Assessors’ Real Estate Database

In recent years, property tax revenue has constituted approx. 70% of the Town’s operating budget. Tax-exempt property value equals approx. 9% of the Town’s total assessed property value, so property tax revenue is raised from the remaining 91%, i.e., taxable property owners. Note that this percentage split can change over time; one factor that can shift value from taxable to tax-exempt is that any additional property acquired by a tax-exempt organization comes off the tax rolls immediately.

One existing source of PILOT payments is Belmont Light, who pays $650,000 annually. The amount of other PILOT payments received in FY21 was $35,063 ($34,063 from Waverley Woods LLC and $1,000 from Belmont Lions Club). The amounts received in FY20 and FY19 were $43,913 and $9,140, respectively.

In 2021, Rep. Erika Uyterhoeven and Sen. Adam Gomez filed a bill for state legislation of PILOT payments—An Act relative to payments in lieu of taxation by organizations exempt from the property tax (H.3080/S.1874). If passed, it will allow municipalities to adopt a bylaw requiring that certain nonprofits owning total property valued at or above $15 million pay up to 25% of the amount that would be paid if the property were not tax-exempt. It further allows for agreements between municipalities and organizations that may provide for exemptions from payment or consideration of community benefits as payment.

The proposed legislation would apply to specific types of tax-exempt property owners, as categorized by state law. For example, it would not apply to recreational land, such as golf courses, whose property tax payments are reduced by Chapter 61B. (Further discussion of Chapter 61B is included below.) In Belmont, there are three organizations to whom the law would apply that own property valued above $15 million: McLean Hospital ($64.6M), Belmont Hill School ($46.2M), and Belmont Day School ($15.4M).

Applying the parameters of this legislation to the applicable tax-exempt properties can inform the maximum incremental revenue the Town could receive if it became law. 25% of the amount that would be paid if their properties were not tax-exempt—using the FY21 tax rate of $11.54 per $1,000 of assessed value—equals $364,067 additional revenue annually. This amount could be decreased by granting exemptions from payment or consideration of community benefits as payment.

As part of researching this idea, members of the Structural Change Impact Group (SCIG) met with Robert Reardon, Chair of Belmont’s Board of Assessors. He stated that PILOT payments are requested on an annual basis, but what the Town receives in PILOT payments is almost nothing. However, SCIG subsequently learned that Belmont Hill’s Head of School said at a public presentation in December 2021 that they haven’t been approached by the Town regarding PILOT payments.

Based on this discrepancy and other discussions, it is clear that the Town needs to make a more concerted effort to engage in dialogue on PILOT payments with our nonprofit organizations. Undoubtedly, the nonprofits that operate here are contributing valuable community benefits, which can be considered as payment, but the Town is lacking transparent accounting/reporting of the value of such community benefits and the value of Town services.

Building relationships with nonprofits will enable this accounting/reporting, and in turn the reporting will strengthen the relationships. Community benefits reporting is mutually beneficial: the Town and taxpayers gain financial transparency, and nonprofit institutions gain public acknowledgement and appreciation of the services that they provide to the community. A recent example of the value of such public/private partnership is Poet’s Corner Park, for which Belmont Hill School approached the town of Arlington about funding a renovation project.

To accomplish this, our recommendation is for the Select Board to establish a PILOT oversight committee, charged as detailed in the Recommendations section below. The work of this committee would serve an important purpose whether or not the pending state legislation is passed. If the bill does not pass, Belmont could still establish a local PILOT program with standardized accounting and reporting. If the bill does pass, Belmont would have a head start on the effort required to adopt and administer it.

Regarding Chapter 61B of Massachusetts General Law, this provides for a specific calculation of property taxes for recreational land and uses, which explicitly includes golfing. According to Section 2, the property assessment value of qualifying recreational land shall not exceed 25% of its fair cash value. This reduced assessment value is then multiplied by the town’s commercial property tax rate to determine the property owner’s tax liability for the land. Because other properties are assessed at full fair market value, Chapter 61B effectively gives recreational land a 75% tax exemption.

While the SCIG agrees that the Chapter 61B exemption merits further exploration as an opportunity for additional revenue, we did not have time for more extensive research into specific legislation to be lobbied at the state level. We recommend that this question be posed to our representatives in the Senate and House.

Recommendations

-

Select Board to establish a PILOT oversight committee:

-

Charged with producing recommendations for a PILOT program, which shall include standards for the accounting and reporting of town services and community benefits

-

May make general recommendations or tailor them to specific institutions or categories of institutions (education, healthcare, cultural institutions, etc.)

-

Thereafter, ongoing responsibility to maintain relationships with nonprofit institutions, monitor compliance with the PILOT program as designed, and ensure community engagement in the valuation of community benefits

-

Identify the point person who will have the authority to speak for the Town in discussions with nonprofit organizations

-

-

In the event Bill H.3080/S.1874 is passed by state legislature, Select Board to present article for Town Meeting to adopt it

-

Select Board to ask Belmont’s State Senator and State Representative whether there are any changes to Chapter 61B being discussed in state legislature

-

Select Board to consider the financial impact of Chapter 61B tax exemptions during the annual tax classification hearing to determine commercial versus residential property tax rates (see Idea #303 for more information on tax classification)

Next Steps

- Select Board to vote approval of the formation of a PILOT oversight committee with the recommended charge, and begin accepting applications

Further Reading

-

See the Idea Matrix (XLS file) for an interactive table of tax-exempt parcels data, titled “Idea 101 Non Profit Parcels”

-

An Act relative to payments in lieu of taxation by organizations exempt from the property tax: https://malegislature.gov/Bills/192/H3080

“Notwithstanding the provisions of section 5 or any other general or special law to the contrary, in a city or town that votes to accept this section pursuant to section 4 of Chapter 4, an organization exempt from taxation under clause third of said section 5 owning total property valued at or above fifteen million shall make payment in lieu of taxation on all real and personal property owned by the organization in the city or town equal to 25 percent of the amount that would be paid if the property were not exempt from taxation. Any city or town that accepts this section shall adopt an ordinance or bylaw to provide for agreements between the municipality and organizations that may provide for exemptions from payment, consideration of community benefits as payment and administration of payments.”

-

Arlington explores renovation and expansion of Poet’s Corner park

https://www.wickedlocal.com/story/arlington-advocate/2022/01/10/arlington-explores-renovation-and-expansion-poets-corner-park/9121002002/ -

State audit of PILOT program funding

https://www.mass.gov/doc/payment-in-lieu-of-taxes-pilot-june-2001/download